Notes from the Front Row: Optimism and Laxatives - My Observations from The Lodging Conference

Day 1 and 2: JW Marriott Desert Ridge, Phoenix

From my seat in the front row, it was clear that The Lodging Conference was equal parts optimism and indigestion. Or, as Harry Javer put it when he opened Day Two, “If you had to describe our industry in one word, what would it be?”

The first answer he got: “Laxative.”

Cue laughter. Then came “challenging,” “unclear,” “opportunity,” and “stuck.” That combination pretty much summed up the mood across two days at the JW Marriott Desert Ridge — equal parts anticipation and anxiety, ambition and backlog.

Day One: The Dealmakers — From NUGs to NRG

Stephanie Ricca from CoStar kicked off the conference by asking each brand development leader how they were feeling about 2025. The question drew polite chuckles, but the responses were telling.

“Optimistic,” said Hilton’s Christian Charnaux.

“Momentum,” said Hyatt’s Dan Hansen.

“Thankful,” said IHG’s Kevin Schramm.

And David Pepper from Choice summed it up best: “It’s been a year of delayed optimism — but we’re starting to see it now.”

The alphabet soup of growth acronyms got its own subplot. Hilton still talks about NUG—Net Unit Growth—while Hyatt has rebranded the same idea as NRG (eNeRGy), for Net Rooms Growth. “It’s the energy behind how we grow,” Hansen said, smiling. Energy beats units every time.

The panelists may use different acronyms, but the themes were consistent:

• A resilient pipeline fueled by conversions and new brands.

• Key money coming back into play.

• A surprisingly healthy sense of long-term confidence.

Pepper described Choice’s focus on “proven prototype, proven margin, proven exit,” while pointing to a quietly undersupplied market north of the border. “Canada is a big opportunity for us,” he said. “Double-digit RevPAR increases, and they’re not overbuilt.”

As the conversation turned to owner pain points, the mood stayed pragmatic. PIPs have been deferred since COVID, costs are up, and everyone’s underwriting is tighter—but there was a sense that the brands are meeting owners halfway.

“It’s a great time to be an owner,” Pepper said flatly. “Brands are putting in key money, and they’re motivated. We all win when assets upgrade.”

Hansen agreed, framing it as a long game: “If I’m an owner, I’m thinking five or ten years out—where do I want to be, and with whom? The right brand, in the right market, with the right story.”

The big story wasn’t just NUG or NRG—it was flexibility. Smaller footprints. More conversions. Brand extensions built for white space. Hilton launched its 25th brand, The Outset Collection, that morning. Wyndham introduced Dazzler Select, an economy lifestyle soft brand. Even IHG’s “micro-lifestyle” Ruby got a mention.

All of it added up to a collective message: growth is still happening, but in smarter, leaner ways.

Day Two: Speed Stats and Mood Swings

If Day One was about optimism, Day Two was about digestion, and maybe a little indigestion.

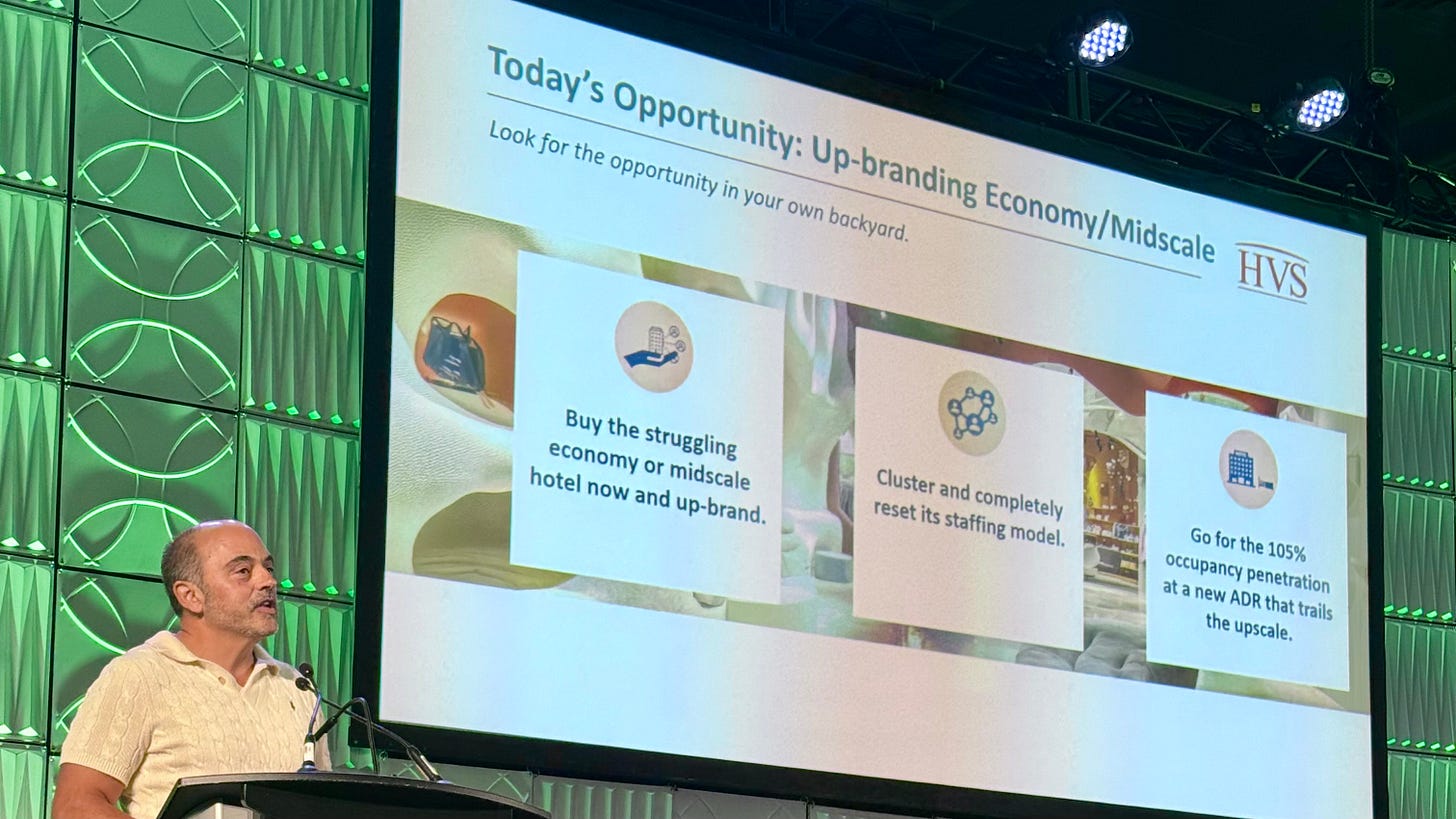

Harry Javer’s “laxative” opener got the room laughing, but the laughter faded as the data rolled in. Rod Clough of HVS urged the crowd to “seize the opportunity” in the overlooked corners of the market. “Buy the nine-and-a-half cap,” he said. “Transform the value. Up-brand. Be patient.”

Then Isaac Collazo from STR followed with a sobering line: “The industry is stuttering.”

Room demand has fallen for five straight months. ADR growth is below inflation. “Flat,” he said, “is the new up.”

JP Ford from Lodging Econometrics offered a counterbalance: the construction pipeline is still strong—just smaller. “We’re building more hotels with fewer rooms,” he said. “Renovations and conversions are where the action is.”

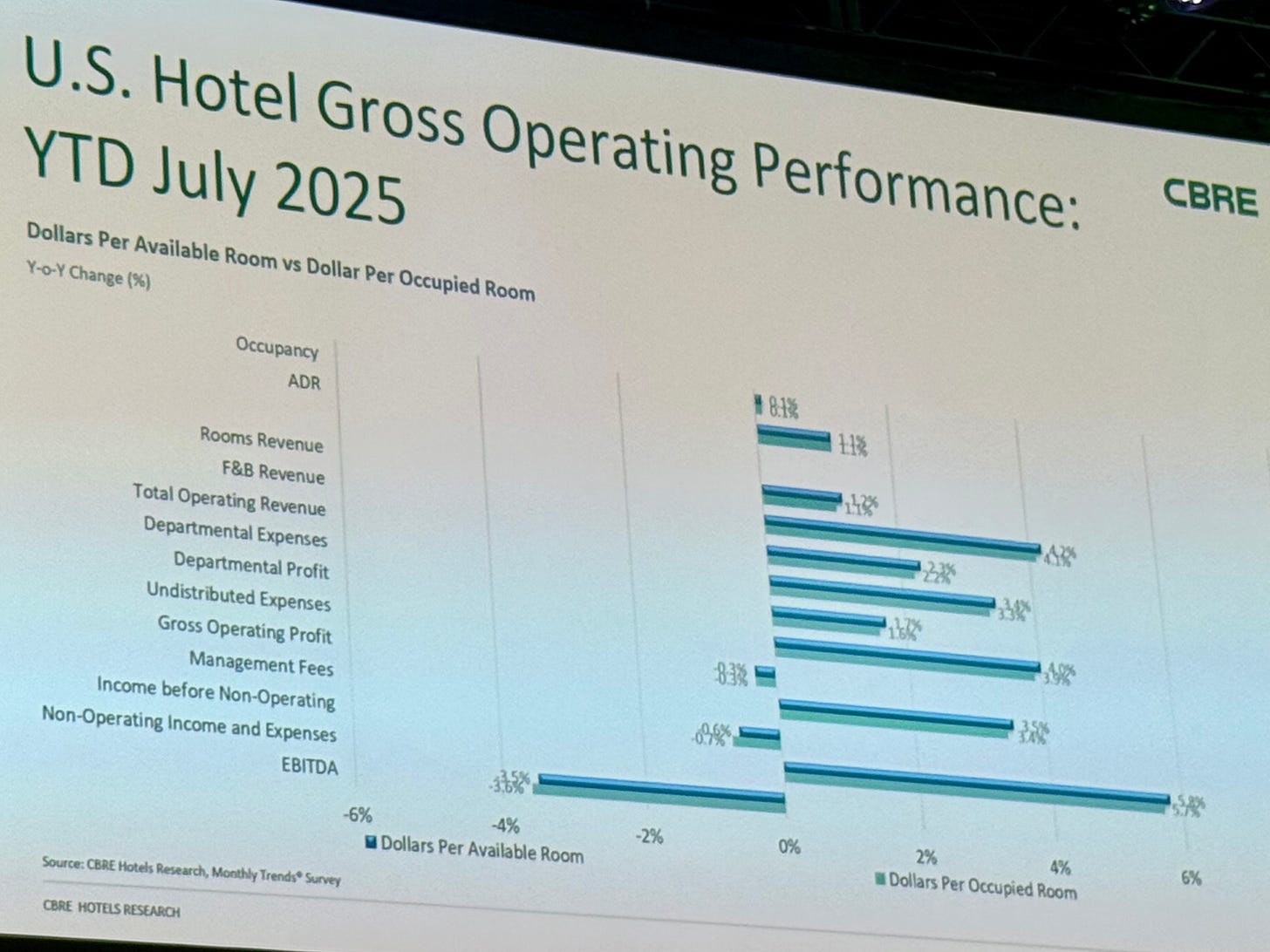

Andrea Grigg from CBRE delivered one of the more memorable slides of the week: EBITDA down 3.5%. “The wheels came off in Q2,” she said, but added, “Not everything is lost. The opportunities live in efficiency—in how you manage the fixed costs everyone else ignores.”

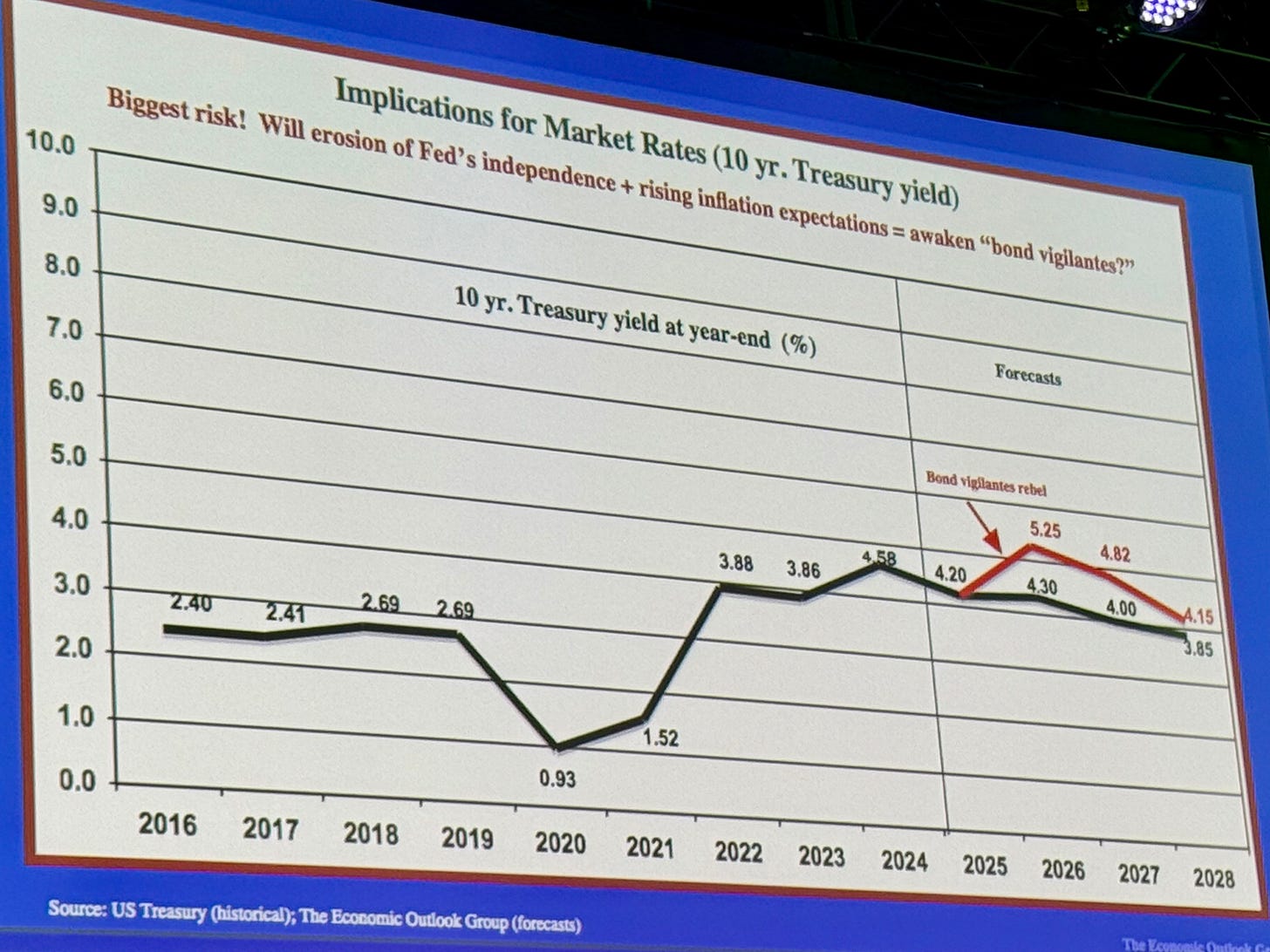

Then came economist Bernard Baumohl, who could’ve been mistaken for a stand-up comic if his topic weren’t so grim. “No recession,” he said. “Just chaos.” Tariffs, Treasury yields, shutdowns, stagflation threats—take your pick. It reminds me of a common Scott Galloway, “Prof. G” statement that - “The only adult in the room is the ten-year bond.” - he puts the odds of the bond vigilantes below driving up rates at 40%. So let’s all hope the 60% path takes hold.

Sustainability, Survival, and “Operators Crushing It”

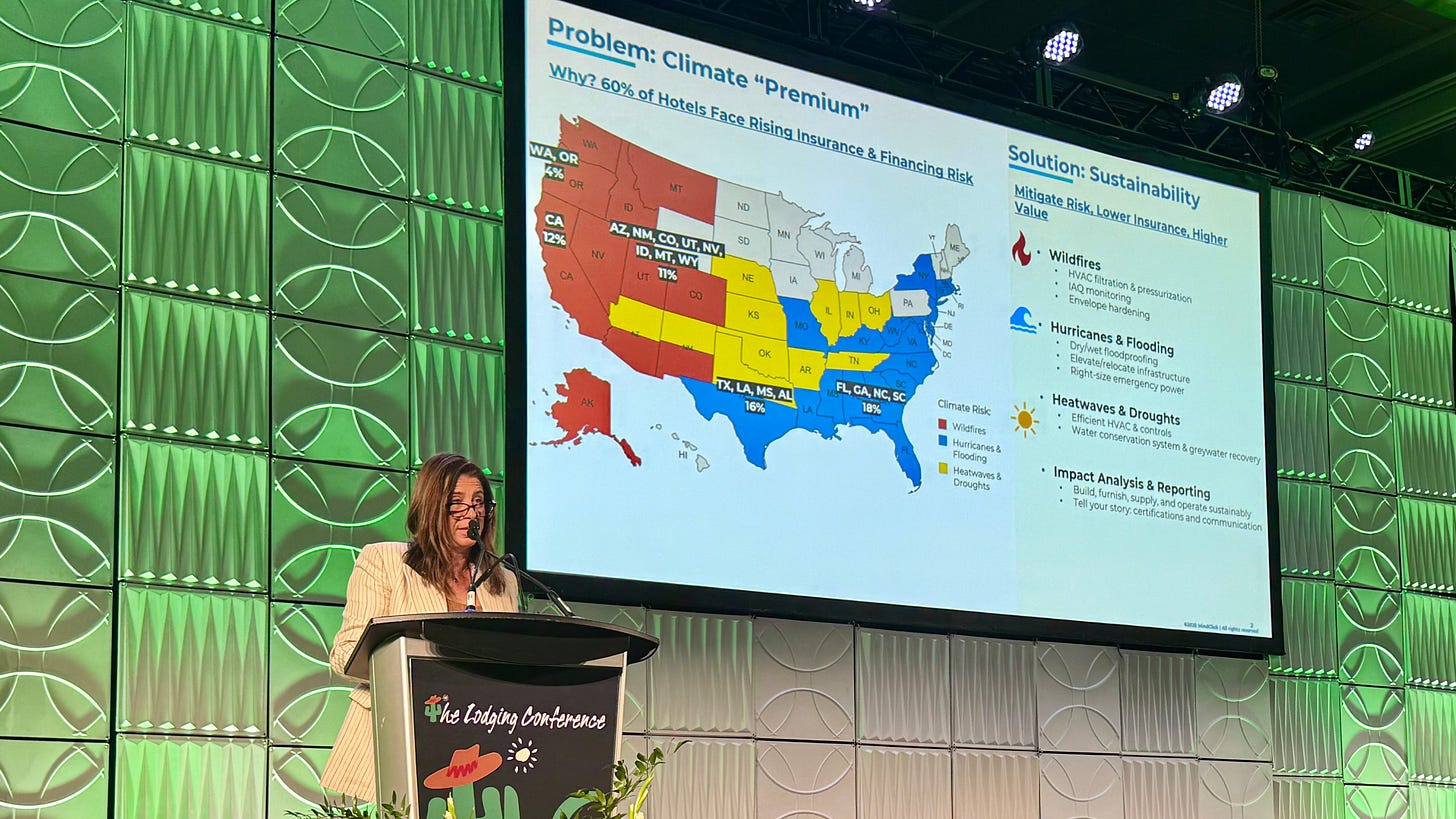

The afternoon brought a reset in tone. Joanna Abrams of MindClick took the stage and reframed sustainability as a straight business play: “Energy costs are up, but efficiency is profit.” She pointed to $6 billion in C-PACE financing available for retrofits and noted that certified “rated” hotels are already winning more RFPs from corporate buyers. “Sustainability isn’t a box to check—it’s revenue protection.”

Cindy Estis Green followed with hard data from Kalibri Labs. Corporate and group travel are both down, she said, but extended stay remains a quiet outperformer. “The pain is evenly spread,” she noted. “But we’ve been through worse.”

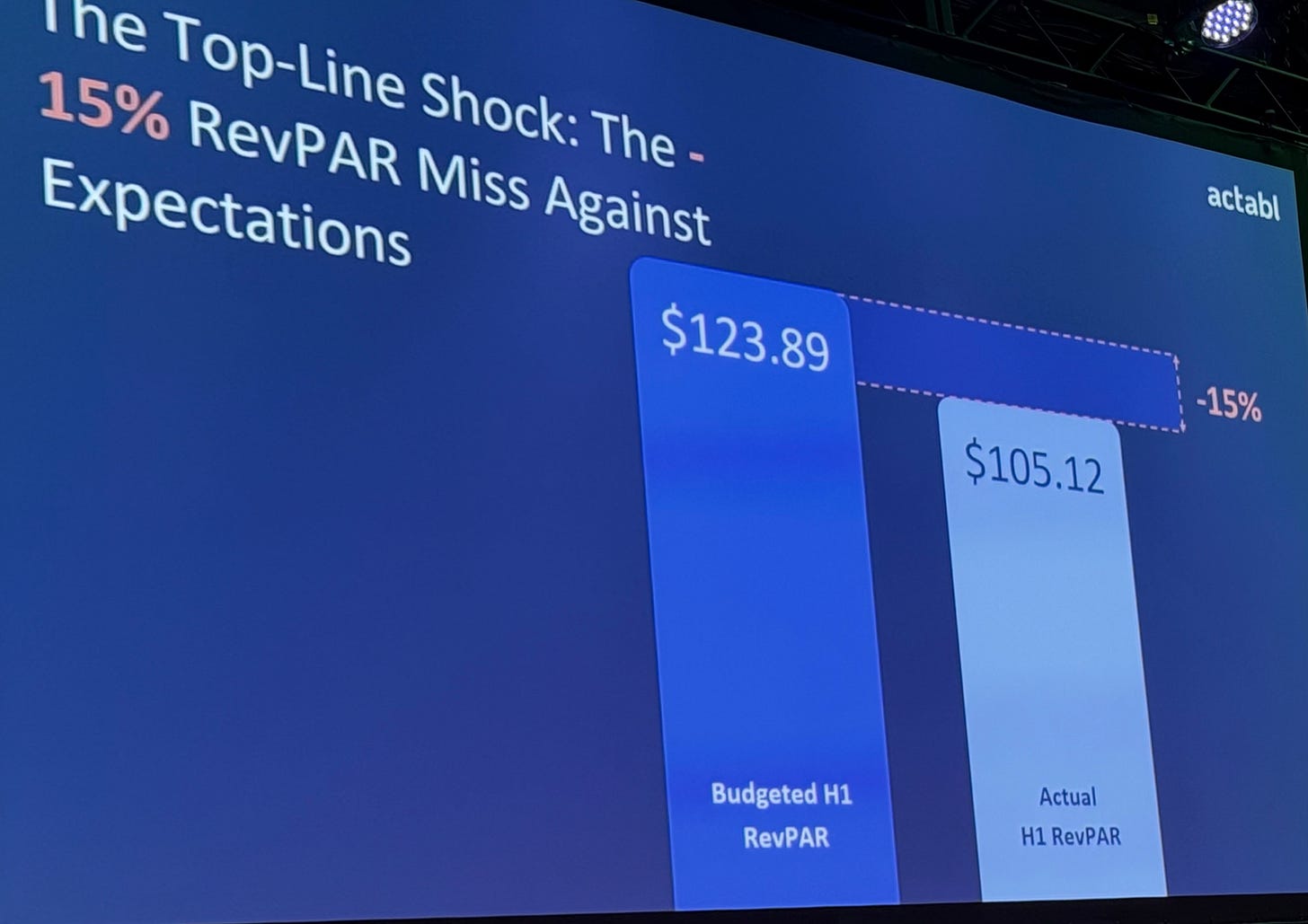

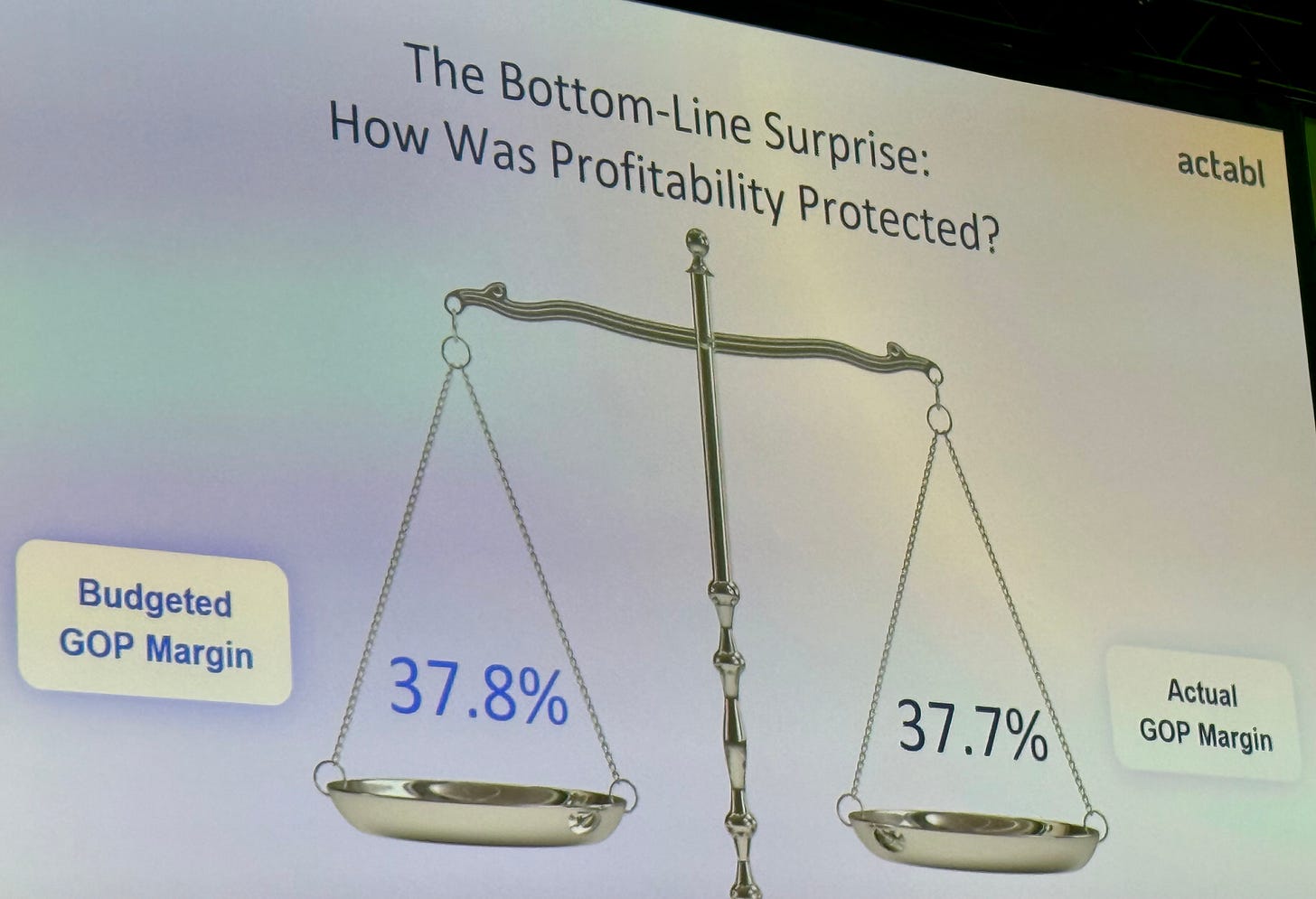

Then came my favorite line of the conference. Lindsey Goedeker from Actabl looked straight at the audience and said: “Operators are crushing it.”

Even with top-line revenues down 15%, GOP margins were flat. “You’re pivoting,” she told them. “You’re finding the inflection points.” Her example: resorts cutting room labor costs by $14 per occupied room—saving roughly $300,000 a year without hurting guest experience. And as I always believe - you can’t change things without measuring them, so I’m guessing that Actabl provides some pretty detailed telemetry to the operators who are crushing it.

Tanya Venegas closed with a global snapshot: U.S. and Europe lagging the Middle East and Asia in profit flow-through, labor costs at 50%-plus of revenue, and utilities climbing fast. Her point: profitability now depends more on discipline than demand.

Unstuck

By the end of Day Two, the words “laxative,” “momentum,” and “resilient” had all made their rounds. But the throughline wasn’t about being stuck—it was about getting smarter.

Across two days, I heard data, strategy, and humor all orbit the same truth: we’re not growing the way we used to, but we’re still growing. Through conversions, through efficiency, through storytelling.

As Liam Brown and Craig Smith reminded everyone later that afternoon, hospitality’s biggest blind spot isn’t capital—it’s advocacy. “We don’t tell our story well enough,” Liam said. “We forget how much impact hotels have on communities.”

Maybe that’s the real lesson from the desert: the numbers matter, but the narrative matters more.

If “laxative” was the word of the week, maybe it fits. We’re clearing what’s been stuck—one deal, one pivot, and one story at a time.