Notes from the Front Row: Renovation Math, Guest Love, and Faster Money

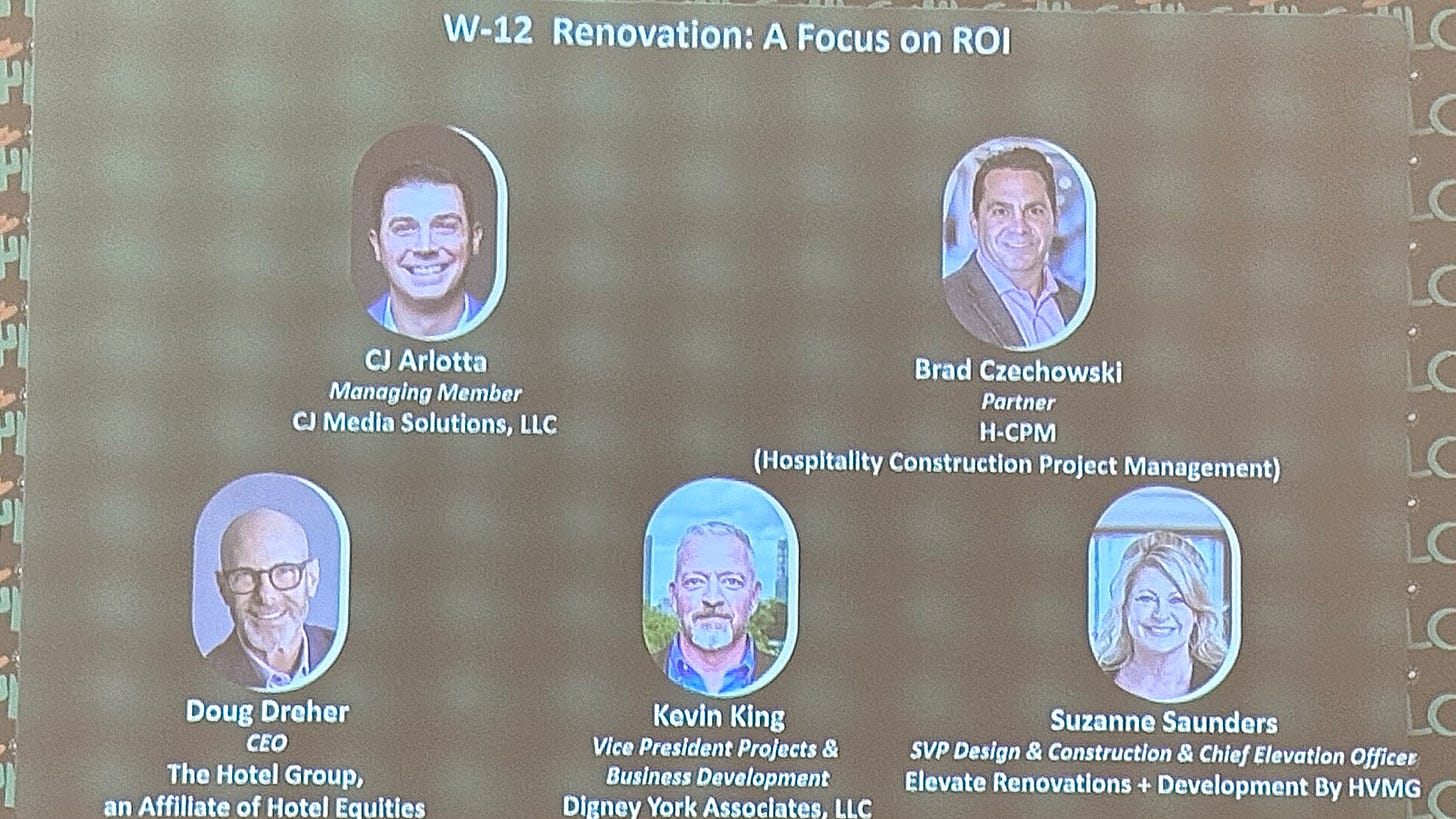

The Lodging Conference - JW Marriott Desert Ridge, Phoenix - Day 3 Breakout Session - “Renovation: A Focus on ROI”

This session was a tug-of-war between consistency and uncertainty. If the renovation cycle doesn’t change and adapt anytime soon, the outcomes will be “like a box of chocolates; you never know what you’re going to get.”

Consistency is what brands and owners want to sell; uncertainty is what tariffs, interest rates, labor, and supply chains keep handing them. You can read my thoughts on those in last week’s post here:

The interesting part was where everyone landed: speed is back, lenders need educating, capex discipline has to grow up, and guest satisfaction is finally steering more of the renovation agenda.

What changed: ❤️GUEST LOVE❤️(or more accurately, HATE) is finally steering the spend!!

The line that stuck with me: brands (Hilton was named specifically) are weighing guest satisfaction more heavily when they prioritize and pace PIPs.

Think “curated PIPs” tied to stay scores and inspections instead of rigid cycles. If you’re performing, you can flex timelines and focus on the items that actually move guests into the “intent-to-return” column. Guest surveys finally matter again - HOORAY!

Remind me to tell you a very cringe-worthy story about me filling out a guest satisfaction survey in Orlando the next time you see me. It’s too cringy to share here.

Doug Dreher called out Hilton’s approach: if your stay score and Quality Assurance show you care, “they’ll give you a little more timeline on the fixed renovation cycle.”

Suzanne Saunders added that another brand is moving to a good-better-best numeric model, so an Omaha hotel and a Miami twin aren’t treated like clones.

Same flag, different wear patterns, different PIPs. That’s sanity.

Why that matters: We’ve lived in an era of almost six years of deferred capex while guests continue to pay 2019-plus rates (although my last post shows ADR is now softening). A brand stance that marries QA and stay scores to PIP timing is a welcome correction in my book.

Capex reality: 4% isn’t enough anymore

The panel didn’t mince words. “Four percent is way too low,” Dreher said.

Set the baseline at 6% and increase it to 8% for big-box full-service once you include chillers, boilers, transformers, FF&E, and fan-coil systems.

That’s a sea change owners should embrace if we want to stop patching as an industry and start performing to win the guest’s love back. Sustainability measures didn’t come up in this part. Still, as JoAnna Abrams mentioned earlier in the conference, this is where CapEx, potentially sprinkled with some C-Pace Financing and new systems, can improve the bottom line through energy efficiency and increase cash-on-cash returns. It will also help, as she showed, boost group sales to the property.

One practical anecdote I loved:

Midwest airport Marriott: converting fan-coil units “in less than a day,” container by container, year after year:

Guest dissatisfaction skyrocketed in fall and spring because the fan coils only kicked on when it was too hot or too cold—summer or winter—leading to a rise in intent to return.

One of my favorite lines was used: How do you eat the elephant? One bite (or container) at a time, there’s no need to invest everything on MEP at once; you can space out big-ticket items.

Non-traditional lenders: try to teach them hospitality’s feverish cadence early

We heard a painful example: a lender wouldn’t release the first 50% of funding, intended for FF&E and other deposits, until the product was in-country.

Of course, you need the deposit to purchase and ship it. Draws took 45-60 days. Net result: schedules blew up and had to be redone.

Three takeaways:

Vet your lender for hospitality experience. If not, define reality in the loan agreement—especially the draw mechanics and documentation.

Build working capital into the budget for the revenue dip and lagging draws; renovations aren’t traditional refis.

Educate early: show the business plan, ramp assumptions, displacement analysis, and why the timing of deposits matters to land goods on time.

Schedules and speed: velocity is alpha again

For a decade, owners optimized for consistency. Now, as Kevin King put it, “speed is becoming a factor again.”

Practical speed plays from the panel:

Renovate in low-occupancy windows, not the cycle’s preferred date. Suzanne is pushing from November to March with three floors at a time to maintain momentum to avoid displacing heads in beds.

Pad your lead times. A recent “typhoon in China” story delaying both lighting and casegoods is the new normal. If the spec says 20-24 weeks, plan for 28-30.

Bring contractors into design to reality-check pricing early; eliminate rework loops before they metastasize.

Brand flexibility ≠ brand drift

Yes, flexibility is up. But that doesn’t mean settle. It means negotiate the scope where it doesn’t drive RevPAR or guest love—and redeploy spend where it does.

Examples from the room:

Keep tubs in heavy international markets, waive the shower-conversion blanket, and expand the bar that actually throws off revenue.

Localize where it counts (artwork, signage, small “you are here” moments) while meeting the brand’s core promise.

Transparency is a force multiplier

Suzanne’s method is the one every owner should steal: share the budget up front with designers, purchasers, and manufacturers.

Break it down by line (“sofa = X,” “lighting = Y”), set a real target, and let experts trade across the package.

Also, ask manufacturers to value-engineer the design with you - they know their cost drivers better than any of us.

Do that, and your schedule compresses.

In my experience, putting the numbers on the table on day one can shrink the timeline from 18-24 months down to around 12.

And if all you save is eight weeks? That’s still 5-10x faster revenue back to investors than the old way of designing in the dark and repricing, value engineering, etc. which leads to delays.

It won’t fit every project, but when it does, it’s magic.

Case studies forthcoming—I’m in the middle of a couple of projects like this right now.

A few quick hitters to close

Brand waivers: Be selective and meet in person. “If someone emailed me, I said no. If we met and they explained, we found a path,” Suzanne said. The panel’s hit rate: around 75% when the case is clear. Human interaction matters!

Displacement analysis beats the calendar: schedule to occupancy, not to PIP anniversaries.

Scope swaps with purpose: remove low-ROI scope to fund revenue drivers or address guest dissatisfaction.

Plan for volatility: tariffs, labor, storms, ports—your schedule needs slack by design.

The throughline

Renovation ROI in 2025 isn’t just about what you buy; it’s how fast you get back to selling nights guests actually want.

Raise the capex reserve. Tie scope to guest love. Educate your lender. Share the budget.

And run, Forrest, run!

If 2020-2024 was the era of deferred capex, 2026 and beyond needs to be the era of disciplined velocity.